While the new Suga administration is forcefully advancing the digitalization of government services, the real aim of such reforms, points out economist Kazumasa Oguro, should be to ensure that tax and social security benefits reach those who most need them through push-type services.

* * *

Prime Minister Yoshihide Suga has identified one of his top policy priorities to be the creation of a new digital agency. This is clearly important, but one must remember that the e-Japan initiative, launched 20 years ago in 2000 by Prime Minister Yoshiro Mori with the aim of creating a Japanese-style IT society has yet to be realized. This initiative ran up against such obstacles as the protection of privacy rights, but there were other hindrances as well. To avoid repeating the same mistakes, it will be important for the government to clearly identify the true aims of digital government.

Digital government is not an end an itself but simply a means. The allocation of resources in the economy fundamentally relies on the market mechanism. But markets are not foolproof, resulting in the need for government intervention, which, from a fiscal perspective, can be categorized into (1) resource allocation, (2) redistribution of income, and (3) economic stabilization.

Resource allocation enables the provision of public goods that cannot be supplied by the private sector. The redistribution of income seeks to narrow the wealth gaps created by market forces through taxes and the social security system. And economic stabilization helps reduce wild swings in the business cycle through built-in stabilizers, such as fiscal stimulus and a progressive income tax scheme.

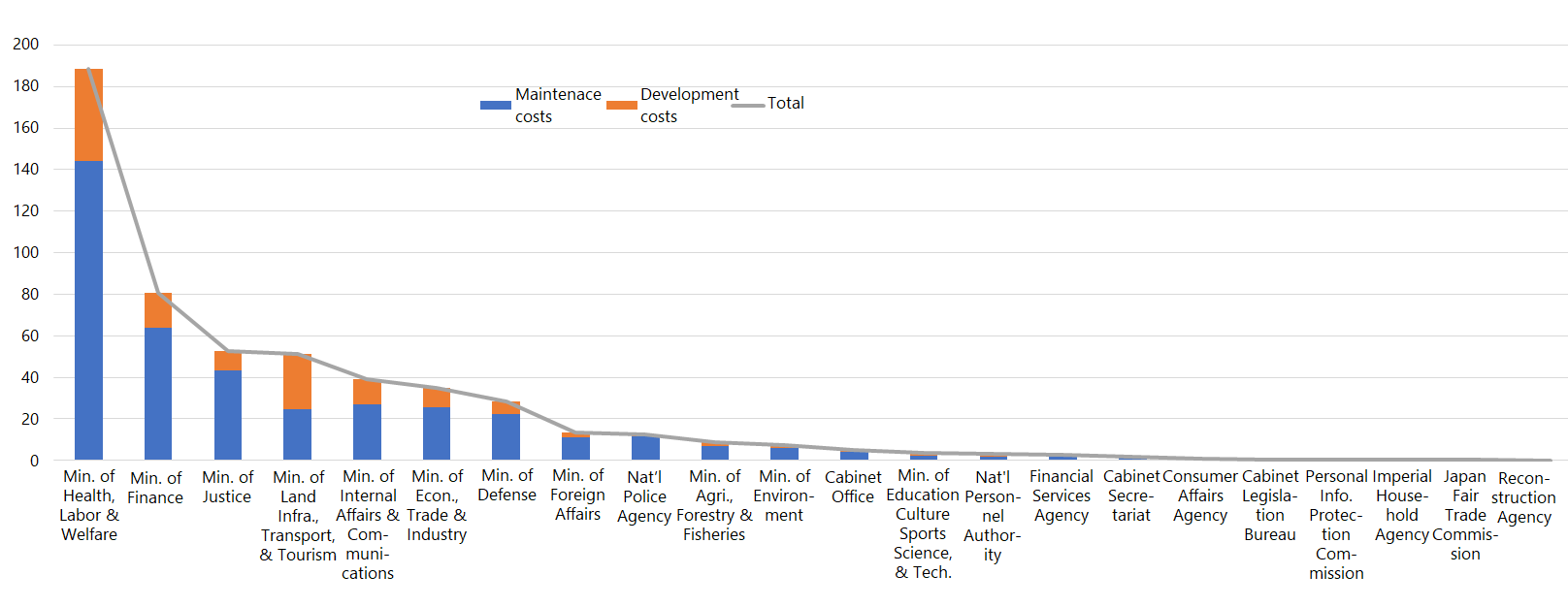

Budget Allocations for Government Information Systems (\ billion, FY 2016)

Source: Compiled by the author based on the Cabinet Secretariat’s “Roadmap for Reform of Government Information Systems,” 2017.

Source: Compiled by the author based on the Cabinet Secretariat’s “Roadmap for Reform of Government Information Systems,” 2017.

Of the three functions, the most important is the redistribution of income, which can be ascertained from the budget for government information systems (as defined by the Standardized Guideline on Promoting Digital Government).

The government agencies with the biggest IT budgets in fiscal 2016, as shown in the above figure, were the Ministry of Health, Labor, and Welfare with \188.4 billion and the Ministry of Finance with \80.9 billion. The MHLW’s IT budget is dominated by items related to pensions, healthcare, and unemployment insurance, which forms part of its basic pension number management system. The MOF budget is dominated by items related to the National Tax Administration System. The two ministries alone accounted for just over half of the total fiscal 2016 IT budget of \535.4 billion.

What this shows is that talk of a digital government is essentially about tax and social security. It is integrally related to the second function of fiscal policy, that is, income redistribution.

Flaws in the System

In Japan, this is currently a function with serious flaws, as became painfully evident when the government tried to distribute \100,000 in emergency COVID-19 relief to all citizens. Unlike the United States, Australia, South Korea, and other countries, Japan was unable to make the payments quickly and correctly. This may largely have been due to the lack of enthusiasm with which political leaders have been advancing e-government—a push-type information service—over the past two decades.

Another major flaw is the lack of a coherent reform strategy. In my Nihon keizai no saikochiku (Rebuilding the Japanese Economy), published by Nikkei Publishing earlier this year, I called for a transparent and simple digital government to ensure that benefits reach people who need them and that burdens are fair.

I would emphasize the importance of assuring that benefits are duly disbursed. Traditional government services were centered on a pull model, where people needed to apply to receive a certain service. Push services, by contrast, are initiated by the government.

Under a pull system, residents who remain unaware of the latest reforms may not receive the full benefits or tax breaks to which they are entitled. Under a push-type, e-government system, on the other hand, those who have registered such information as annual income, age, family structure, spouse’s annual income, and bank account will automatically be notified of—and receive—all new social security benefits and tax refunds.

Such services cannot be offered, though, if citizens do not register their information on a government website. The best tool we have at the moment is the My Number taxpayer ID system that was launched in January 2016. For it to serve as the core of e-government, enabling push-type services, users must first be obligated to link their number to personal information, including bank accounts. The payment of benefits may need to be withheld from those who do not register such information.

Just as important will be the political will to overhaul the government’s information systems. The total government budget for IT-related expenditures in fiscal 2016 was approximately \535.4 billion, which was allocated for three major categories of expenses: (1) development, that is, temporary outlays to introduce or upgrade information systems, (2) maintenance, comprising recurring operation and servicing costs, and (3) spending on nongovernmental information systems.

As a general rule, the development of new systems makes up just a fifth of the IT budget, with the rest being used to maintain and operate those systems. This also appears to hold true in such sectors as construction and real estate. Indeed, of the \535.4 billion IT budget, development costs (the sum of the first and third categories cited above, or \135.2 billion) account for around 25% of the total. The remaining 75% (\400.1 billion) is for the second category of maintenance and other running costs. In fiscal 2019, the IT budget is estimated to have jumped to about \700 billion.

Given the costs involved, the aim of digitalization should not simply be to replace an outdated, analog system symbolized by the continuing use of the hanko (personal seal) to authorize government documents. Greater attention must be paid to harnessing the full powers of digitalization to achieve and enhance push-type administrative services.